Fortified Security Solutions trusted by insurers for proactive protection

Protect, Prevent & Lower Risks with Proactive Perimeter Control

Fortified security solutions designed to reduce claims and streamline underwriting processes.At Proactive Perimeter Control, we work hand-in-hand with insurance companies to manage risks before they become claims. Our innovative, all-in-one security solutions cover residential, commercial, institutional, and retail assets—ensuring that every property is a step closer to safer, more predictable losses.

Schedule Your Free Security Consultation

Why Insurance Companies Choose Us

Why Insurers Trust Proactive Perimeter Control

Minimizing risks and protecting assets for a lower claims profile.

Insurance companies benefit from our proactive security measures, which help reduce the frequency and severity of claims. Our advanced technology and unified approach deliver comprehensive protection, lowering exposure to unforeseen events and contributing to a more favorable risk profile for insured properties.

Enhanced Risk Mitigation

Lower Claim Frequency: Advanced perimeter protection, reinforced structures, and smart monitoring drastically reduce incidents of theft, vandalism, and property damage.

Proactive Protection: Our holistic solutions cover everything from forced entry prevention to dynamic safety screenings, ensuring properties are secure at all times.

Financial & Underwriting Advantages

Reduced Premiums & Deductibles: By lowering the risk of losses, our tailored security installations help position properties for more favorable insurance terms.

Improved Loss Ratios: Robust protection translates into fewer losses, thereby supporting a healthier bottom line for insurers and tighter underwriting standards.

Site-Specific Solutions

Scalable Systems

Smart Surveillance & Detection

Innovative Deterrent Systems

Advanced technologies like fog security, reinforced switchable glass, automated gates, and perimeter alarms deter intruders before damage occurs.

Empowering Insurance Companies for a Smarter Future

Our Security Solutions — Tailored for Insurers

Industry-Focused Strategies

Scalable Digital Solutions

Dedicated Partnership Approach

Comprehensive Solutions for Every Asset Type

Our Security Solutions — Tailored for Insurers

Residential Security Solutions

Perimeter Protection

Security & Safety

Screens

Security Films

Safe Rooms & Fortified Homes

Glass, Stone & Metal Protective Coatings

Commercial Security Solutions

Perimeter Protection

Storefront Glass & Doors Forced Entry Prevention

Ballistic Barrier

Threat Protection System

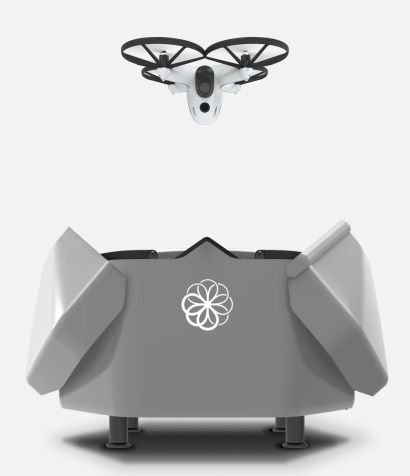

Autonomous Security Drones

Surveillance footage aids in claims processing and proof of loss.

Smart Fog Cannons

Real-World Success Stories

Proven Results: Case Studies

Case Study 1

Residential Case Study

A luxury home facing repeated break-in attempts.

- Solution Provided: Perimeter Protection, Security Window Films & Safe Room Installation. Insurance Involvement: The homeowner's insurance provider recognized the added security upgrades and provided premium discounts for risk mitigation.

Case Study 2

Commercial Case Study

Retail storefront vulnerable to forced entry and vandalism.

- Solution Provided: Storefront Glass Forced Entry Prevention & Smart Fog Cannons. Insurance Collaboration: Worked closely with the client's insurance provider to meet property security standards, resulting in reduced theft coverage costs.

Case Study 3

Institutional Case Study

- To enhance the safety of schools and meet insurance risk mitigation standards, we provided a comprehensive security solution. This included Forced Entry Prevention Glass on main entry points, Ballistic Resistance Blinds for windows and doors, and Bulletproof Plaster Mix Coating in high-risk zones like administrative offices and reception areas—ensuring an added layer of protection against potential threats.

Case Study 4

Retail Case Study

High-end jewelry store needing advanced protection.

- Solution Provided: Forced Entry Prevention Glass, Smart Fog Cannon, Ballistic Barrier, Security Coatings, Surveillance Systems Insurance Requirement: Met strict security standards required by the client’s insurer to maintain full coverage. We delivered a layered security solution, including Forced Entry Glass on entry points, a Smart Fog Cannon for instant visibility suppression, Ballistic Barriers, and Security Coatings—ensuring enhanced protection and insurance compliance.

Testimonials

What Our Clients Say

Laura Henderson

Underwriting Manager

James Rodriguez

Claims Director

Kathy Lin

Risk Management Executive

Robert Matthews

Senior Actuary

Sarah Thompson

Senior Claims Manager

Mark Jensen

Risk Assessment Specialist

Stay Informed with the Latest News and Real-Life Security Insights from Proactive Perimeter Control

News & Videos Highlights

Why Choose Proactive Perimeter Control for Your Property's Security and Insurance Needs

When it comes to protecting valuable assets and minimizing risk, Proactive Perimeter Control offers unmatched fortified security solutions that directly benefit insurance companies. Our Fortified security solutions not only provide proactive protection but also help lower claims and streamline underwriting processes.

By partnering with Proactive Perimeter Control, insurers can reduce the frequency and severity of claims. Our cutting-edge technologies, including smart fog cannons, ballistic barriers, security drones, and forced entry prevention glass, work together to keep properties secure and mitigate potential threats. This proactive approach results in fewer and less severe claims, which ultimately lowers exposure to unforeseen events and helps create a more favorable risk profile for insured properties.

Proactive Perimeter Control works hand-in-hand with insurance companies, ensuring that both insurers and property owners can benefit from comprehensive protection that reduces risks and increases property safety. Let us help you safeguard your clients’ properties and protect your bottom line.